0000819050Q2FALSE202212/31.0222.022200008190502022-01-012022-06-3000008190502022-08-11xbrli:shares00008190502022-06-30iso4217:USD00008190502021-12-31iso4217:USDxbrli:shares0000819050us-gaap:ProductAndServiceOtherMember2022-04-012022-06-300000819050us-gaap:ProductAndServiceOtherMember2021-04-012021-06-300000819050us-gaap:ProductAndServiceOtherMember2022-01-012022-06-300000819050us-gaap:ProductAndServiceOtherMember2021-01-012021-06-300000819050us-gaap:RoyaltyMember2022-04-012022-06-300000819050us-gaap:RoyaltyMember2021-04-012021-06-300000819050us-gaap:RoyaltyMember2022-01-012022-06-300000819050us-gaap:RoyaltyMember2021-01-012021-06-3000008190502022-04-012022-06-3000008190502021-04-012021-06-3000008190502021-01-012021-06-300000819050us-gaap:CommonStockMember2021-12-310000819050us-gaap:AdditionalPaidInCapitalMember2021-12-310000819050us-gaap:RetainedEarningsMember2021-12-310000819050us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-3100008190502022-01-012022-03-310000819050us-gaap:RetainedEarningsMember2022-01-012022-03-3100008190502022-03-310000819050us-gaap:CommonStockMember2022-03-310000819050us-gaap:AdditionalPaidInCapitalMember2022-03-310000819050us-gaap:RetainedEarningsMember2022-03-310000819050us-gaap:CommonStockMember2022-04-012022-06-300000819050us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300000819050us-gaap:RetainedEarningsMember2022-04-012022-06-300000819050us-gaap:CommonStockMember2022-06-300000819050us-gaap:AdditionalPaidInCapitalMember2022-06-300000819050us-gaap:RetainedEarningsMember2022-06-3000008190502020-12-310000819050us-gaap:CommonStockMember2020-12-310000819050us-gaap:AdditionalPaidInCapitalMember2020-12-310000819050us-gaap:RetainedEarningsMember2020-12-310000819050us-gaap:CommonStockMember2021-01-012021-03-310000819050us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-3100008190502021-01-012021-03-310000819050us-gaap:RetainedEarningsMember2021-01-012021-03-3100008190502021-03-310000819050us-gaap:CommonStockMember2021-03-310000819050us-gaap:AdditionalPaidInCapitalMember2021-03-310000819050us-gaap:RetainedEarningsMember2021-03-310000819050us-gaap:CommonStockMember2021-04-012021-06-300000819050us-gaap:AdditionalPaidInCapitalMember2021-04-012021-06-300000819050us-gaap:RetainedEarningsMember2021-04-012021-06-3000008190502021-06-300000819050us-gaap:CommonStockMember2021-06-300000819050us-gaap:AdditionalPaidInCapitalMember2021-06-300000819050us-gaap:RetainedEarningsMember2021-06-300000819050bbi:BotanixMemberbbi:MilestonePaymentsMembersrt:MaximumMember2022-06-300000819050us-gaap:SubsequentEventMember2022-07-052022-07-05xbrli:purebbi:segment0000819050us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-06-300000819050us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310000819050us-gaap:WarrantMember2022-04-012022-06-300000819050us-gaap:WarrantMember2022-01-012022-06-300000819050us-gaap:WarrantMember2021-01-012021-06-300000819050us-gaap:WarrantMember2021-04-012021-06-300000819050us-gaap:EmployeeStockOptionMember2022-01-012022-06-300000819050us-gaap:EmployeeStockOptionMember2022-04-012022-06-300000819050us-gaap:EmployeeStockOptionMember2021-01-012021-06-300000819050us-gaap:EmployeeStockOptionMember2021-04-012021-06-300000819050us-gaap:RestrictedStockUnitsRSUMember2022-04-012022-06-300000819050us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-06-300000819050us-gaap:RestrictedStockUnitsRSUMember2021-04-012021-06-300000819050us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-06-300000819050bbi:CarnaBiosciencesIncMember2022-02-020000819050bbi:VoronoiIncMember2021-08-272021-08-2700008190502021-08-272021-08-270000819050bbi:KakenMemberbbi:MilestonePaymentsMembersrt:MaximumMember2022-05-030000819050bbi:KakenMembersrt:MaximumMemberus-gaap:RoyaltyMember2022-05-030000819050bbi:BotanixMemberus-gaap:RoyaltyMember2022-04-012022-06-300000819050bbi:BotanixMemberus-gaap:RoyaltyMember2021-04-012021-06-300000819050us-gaap:CollaborativeArrangementMemberus-gaap:RoyaltyMember2022-01-012022-06-300000819050bbi:BotanixMemberus-gaap:RoyaltyMember2021-01-012021-06-300000819050bbi:BotanixMember2022-05-030000819050bbi:BotanixMemberbbi:MilestonePaymentsMember2022-05-030000819050bbi:PaymentCriteriaOneMemberbbi:BotanixMemberbbi:MilestonePaymentsMembersrt:MaximumMember2022-05-030000819050bbi:BotanixMemberbbi:PaymentCriteriaTwoMemberbbi:MilestonePaymentsMember2022-05-030000819050bbi:BotanixMemberbbi:PaymentCriteriaThreeMember2022-05-030000819050bbi:BotanixMemberbbi:UpfrontFeeMember2022-04-012022-06-300000819050bbi:BotanixMemberbbi:ReimbursableDevelopmentExpendituresMember2022-01-012022-06-300000819050bbi:ConsultingServicesMemberbbi:BotanixMemberus-gaap:CollaborativeArrangementMember2022-01-012022-06-300000819050bbi:ConsultingServicesMemberbbi:BotanixMemberus-gaap:CollaborativeArrangementMember2022-04-012022-06-300000819050bbi:BotanixMemberbbi:SublicenseIncomeMember2022-01-012022-06-300000819050bbi:BotanixMemberbbi:SublicenseIncomeMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2022-06-300000819050bbi:ConsultingServicesMemberbbi:BotanixMember2022-05-032022-05-030000819050bbi:BotanixMember2022-05-032022-05-030000819050bbi:BodorLaboratoriesInc.Member2022-05-032022-05-030000819050bbi:BodorLaboratoriesInc.Member2022-01-012022-06-300000819050bbi:BodorLaboratoriesInc.Member2022-04-012022-06-300000819050bbi:BotanixMember2022-04-012022-06-300000819050bbi:BotanixMember2021-01-012021-06-300000819050bbi:BotanixMember2021-04-012021-06-300000819050bbi:BotanixMember2022-01-012022-06-300000819050bbi:PaycheckProtectionProgramMember2020-04-15bbi:renewalTerm0000819050us-gaap:WarrantMember2022-06-300000819050bbi:SharebasedPaymentArrangementOptionOutstandingMember2022-06-300000819050bbi:A2020OmnibusPlanMemberus-gaap:EmployeeStockOptionMember2022-06-300000819050us-gaap:EmployeeStockMember2022-06-300000819050bbi:October2021OfferingMember2021-10-012021-10-310000819050bbi:October2021OfferingMember2021-10-310000819050bbi:July2021PublicOfferingMember2021-07-012021-07-310000819050bbi:July2021PublicOfferingMember2021-07-310000819050us-gaap:CommonStockMemberbbi:October2020OfferingMember2020-10-012020-10-310000819050bbi:October2020OfferingMemberbbi:CommonStockWarrantsMember2020-10-310000819050bbi:October2020OfferingMember2020-10-310000819050bbi:PreFundedWarrantMemberbbi:October2020OfferingMember2020-10-310000819050bbi:CommonStockWarrantsMember2021-06-3000008190502020-10-012020-10-310000819050bbi:PreFundedWarrantMember2020-10-310000819050bbi:October2020OfferingMember2020-10-012020-10-310000819050bbi:October2020OfferingMember2021-06-300000819050bbi:October2020OfferingMember2021-01-012021-06-300000819050bbi:CommonStockPublicOfferingMember2020-06-300000819050bbi:CommonStockPublicOfferingMemberbbi:PreFundedWarrantMember2020-06-300000819050bbi:AccompanyingCommonWarrantMemberbbi:CommonStockPublicOfferingMember2020-06-300000819050bbi:PreFundedWarrantMember2020-06-300000819050bbi:CommonStockPublicOfferingMember2020-06-012020-06-3000008190502020-06-012020-06-300000819050bbi:CommonStockPublicOfferingMember2021-06-300000819050bbi:CommonStockPublicOfferingMember2021-01-012021-06-300000819050bbi:A2021AtMarketIssuanceSalesAgreementMember2021-03-310000819050bbi:A2021AtMarketIssuanceSalesAgreementMember2022-04-012022-06-300000819050bbi:A2021AtMarketIssuanceSalesAgreementMember2022-01-012022-06-300000819050bbi:A2021AtMarketIssuanceSalesAgreementMember2022-06-300000819050bbi:A2021AtMarketIssuanceSalesAgreementMember2021-01-012021-06-300000819050bbi:A2021AtMarketIssuanceSalesAgreementMember2021-04-012021-06-300000819050bbi:A2021AtMarketIssuanceSalesAgreementMember2021-06-300000819050bbi:A2020AtMarketIssuanceSalesAgreementMember2020-04-300000819050bbi:A2020AtMarketIssuanceSalesAgreementMember2022-04-012022-06-300000819050bbi:A2020AtMarketIssuanceSalesAgreementMember2022-01-012022-06-300000819050bbi:A2020AtMarketIssuanceSalesAgreementMember2021-04-012021-06-300000819050bbi:A2020AtMarketIssuanceSalesAgreementMember2021-06-300000819050bbi:A2020AtMarketIssuanceSalesAgreementScenario2Member2021-01-012021-06-300000819050bbi:A2020AtMarketIssuanceSalesAgreementScenario2Member2021-06-300000819050bbi:A2020AtMarketIssuanceSalesAgreementScenario2Member2022-06-300000819050bbi:PrivatePlacementOfferingsMember2020-02-290000819050us-gaap:SeriesAMemberbbi:PrivatePlacementOfferingsMember2020-02-290000819050us-gaap:SeriesBMemberbbi:PrivatePlacementOfferingsMember2020-02-290000819050bbi:PrivatePlacementOfferingsMember2020-02-012020-02-290000819050bbi:LincolnParkMember2020-02-290000819050bbi:LincolnParkMember2020-02-012020-02-290000819050bbi:LincolnParkMemberbbi:PurchaseAgreementMember2020-02-012020-02-290000819050bbi:LincolnParkMemberbbi:PurchaseAgreementMember2020-02-290000819050bbi:RegularPurchaseMemberbbi:LincolnParkMember2020-02-012020-02-290000819050bbi:RegularPurchaseMemberbbi:LincolnParkMember2020-02-290000819050bbi:LincolnParkMemberbbi:PurchaseAgreementMember2021-01-012021-06-300000819050bbi:LincolnParkMemberbbi:PurchaseAgreementMember2022-01-012022-06-3000008190502022-05-25bbi:vote0000819050bbi:EquityIncentivePlan2009Memberus-gaap:EmployeeStockOptionMember2022-06-300000819050bbi:VicalStockIncentivePlanMemberus-gaap:EmployeeStockOptionMember2022-06-300000819050bbi:A2020OmnibusPlanMember2022-05-172022-05-170000819050bbi:A2020OmnibusPlanMemberus-gaap:EmployeeStockOptionMember2022-05-030000819050us-gaap:EmployeeStockMemberbbi:EmployeeStockPurchasePlanMember2022-01-012022-06-300000819050bbi:EmployeeStockPurchasePlanMember2021-04-202022-06-300000819050us-gaap:ResearchAndDevelopmentExpenseMember2022-04-012022-06-300000819050us-gaap:ResearchAndDevelopmentExpenseMember2021-04-012021-06-300000819050us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-06-300000819050us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-06-300000819050us-gaap:GeneralAndAdministrativeExpenseMember2022-04-012022-06-300000819050us-gaap:GeneralAndAdministrativeExpenseMember2021-04-012021-06-300000819050us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-06-300000819050us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-06-300000819050us-gaap:SubsequentEventMemberbbi:A2020AtMarketIssuanceSalesAgreementMemberbbi:PreFundedWarrantMember2022-07-012022-08-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2022

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-21088

BRICKELL BIOTECH, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | |

| Delaware | | 93-0948554 | |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) | |

| | | | | | | |

| 5777 Central Avenue, | Boulder, | CO | | | 80301 | |

| (Address of principal executive offices) | | (Zip Code) | |

(720) 505-4755

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common stock, $0.01 par value per share | BBI | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 11, 2022, there were 2,873,965 shares of the registrant’s common stock outstanding.

BRICKELL BIOTECH, INC.

FORM 10-Q

INDEX

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (“Quarterly Report”) contains forward-looking statements that involve substantial risks and uncertainties for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. All statements contained in this Quarterly Report other than statements of historical fact, including statements relating to future financial, business, and/or research and clinical performance, conditions, plans, prospects, trends, or strategies and other such matters, including without limitation, our strategy; future operations; future financial position; future liquidity; future revenue and payments of any type; territorial focus; projected expenses; results of operations; the anticipated timing, scope, design, progress, results, and/or reporting of data of ongoing and future nonclinical and clinical trials; intellectual property rights, including the acquisition, validity, term, and enforceability of such; the expected timing and/or results of regulatory submissions and approvals; and prospects for commercializing any product candidates of Brickell or third parties, or research and/or licensing collaborations with, or actions of, its partners, including in the United States (“U.S.”), Japan, South Korea, or any other country, or business development activities with other potential partners. The words “may,” “could,” “should,” “might,” “anticipate,” “reflects,” “believe,” “estimate,” “expect,” “intend,” “plan,” “predict,” “potential,” “will,” evaluate,” “advance,” “excited,” “aim,” “strive,” “help,” “progress,” “select,” “initiate,” “looking forward,” “promise,” “provide,” “commit,” “best-in-class,” “first-in-class,” and similar expressions and their variants, are intended to identify forward-looking statements. Such statements are based on management’s current expectations and involve risks and uncertainties. Actual results and performance could differ materially from those projected in the forward-looking statements as a result of many factors. Unless otherwise mentioned or unless the context requires otherwise, all references in this Quarterly Report to “Brickell,” “Brickell Subsidiary,” “Company,” “we,” “us,” and “our,” or similar references, refer to Brickell Biotech, Inc. and its consolidated subsidiaries.

We based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy and business development activities, pipeline legal status, short-term and long-term business operations and objectives, employees, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including those described in Part II, Item 1A, “Risk Factors” in this Quarterly Report, in Part I, Item 1A, “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2021, and in Part II, Item 1A. “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2022, and under a similar heading in any other periodic or current report we may file with the U.S. Securities and Exchange Commission (the “SEC”) in the future. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge quickly and from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business and operations or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this Quarterly Report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. All forward-looking statements are qualified in their entirety by this cautionary statement.

You should read carefully the factors described in Part II, Item 1A, “Risk Factors” in this Quarterly Report to better understand the risks and uncertainties inherent in our business and underlying any forward-looking statements. You are advised to consult any further disclosures we make on related subjects in our future public filings and on our website.

RISK FACTORS SUMMARY

Our business, financial condition, and operating results may be affected by a number of factors, whether currently known or unknown. Any one or more of such factors could directly or indirectly cause our actual results of operations and financial condition to vary materially from past or anticipated future results of operations and financial condition. Any of these factors, in whole or in part, let alone combined with any of the others, could materially and adversely affect our business, financial condition, results of operations, and stock price. We have provided a summary of some of these risks below, with a more detailed explanation of those and other risks applicable to the Company in Part II, Item 1A. “Risk Factors” in this Quarterly Report.

•Our business depends on the successful continued financing, nonclinical and clinical development, regulatory approval, and commercialization of our pipeline assets.

•Clinical drug development for our pipeline assets is expensive, time-consuming, and uncertain. Any data resulting from our trials may not be favorable for further development.

•Our inability to maintain compliance with continued listing requirements of The Nasdaq Stock Market LLC (“Nasdaq”), including if we are unable to maintain the required minimum closing bid price of our common stock, could result in the delisting of our common stock.

•Major public health issues, and specifically the pandemic and related impacts caused by the ongoing spread of COVID-19 and COVID-19 variants, including in terms of constraints on supply chains and human resource availability, could have an adverse impact on our financial condition and results of operations and other aspects of our business and that of our suppliers, contractors, and business partners.

•We have sponsored or supported and in the future expect to sponsor or support clinical trials for our product candidates outside the U.S., and the U.S. Food and Drug Administration (“FDA”) and applicable foreign regulatory authorities may not accept data from such trials; in addition, we may not be allowed alone or with local country business partners to obtain regulatory approval for our product candidates without first conducting clinical trials in each of these other countries.

•We rely and expect to continue to rely on third-party contractors for supply, manufacture, and distribution of preclinical, clinical, and commercial supplies, and possibly sales and promotion, of any future product candidates.

•We may not be able to obtain, afford, maintain, enforce, or protect our intellectual property rights covering our product candidates, including our autoimmune and inflammatory portfolio, and related technologies, that are of sufficient type, breadth, and term throughout the world.

•If we fail to comply with our obligations under our intellectual property and related license agreements, we could lose license rights that are important to our business. Additionally, these agreements may be subject to disagreement over contract interpretation, which could narrow the scope of our rights to the relevant intellectual property or technology, or other key aspects of product development and/or commercialization, or increase our financial or other obligations to our licensors.

•Our receipt of future payments from Botanix SB Inc. (“Botanix”) is contingent on various factors outside of our control, including the successful development, regulatory approval, and commercialization of sofpironium bromide gel, 15%, by Botanix outside of Japan, the successful continued commercialization of sofpironium bromide gel, 5% (“ECCLOCK®”) by Kaken Pharmaceutical Co., Ltd. (“Kaken”) in Japan, and the sufficiency of funds to pay us and Bodor Laboratories, Inc. (“Bodor”), the licensor of this product.

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

BRICKELL BIOTECH, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

(unaudited)

| | | | | | | | | | | |

| |

| | | |

| June 30,

2022 | | December 31,

2021 |

| | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 14,480 | | | $ | 26,884 | |

| | | |

| Prepaid expenses and other current assets | 3,771 | | | 2,716 | |

| Total current assets | 18,251 | | | 29,600 | |

| Property and equipment, net | 45 | | | 58 | |

| Contract asset, net of current portion | 181 | | | — | |

| Operating lease right-of-use asset | 30 | | | 59 | |

| | | |

| Total assets | $ | 18,507 | | | $ | 29,717 | |

Liabilities, redeemable preferred stock, and stockholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 1,263 | | | $ | 1,605 | |

| Accrued liabilities | 1,571 | | | 3,136 | |

| Lease liability, current portion | 36 | | | 69 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Total current liabilities | 2,870 | | | 4,810 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Commitments and contingencies (Note 6) | | | |

| | | |

Redeemable preferred stock, $0.01 par value, 5,000,000 shares authorized as of June 30, 2022 and December 31, 2021; 1 and 0 shares issued and outstanding as of June 30, 2022 and December 31, 2021, respectively | — | | — |

| Stockholders’ equity: | | | |

Common stock, $0.01 par value, 300,000,000 shares authorized as of June 30, 2022 and December 31, 2021; 121,066,161 and 119,377,286 shares issued and outstanding as of June 30, 2022 and December 31, 2021, respectively | 1,211 | | | 1,194 | |

| Additional paid-in capital | 170,350 | | | 169,080 | |

| | | |

| Accumulated deficit | (155,924) | | | (145,367) | |

| Total stockholders’ equity | 15,637 | | | 24,907 | |

| Total liabilities, redeemable preferred stock, and stockholders’ equity | $ | 18,507 | | | $ | 29,717 | |

| | | |

See accompanying notes to these condensed consolidated financial statements.

BRICKELL BIOTECH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2022 | | 2021 | | 2022 | | 2021 |

| Revenue | | | | | | | |

| Contract revenue | $ | 4,315 | | | $ | — | | | $ | 4,315 | | | $ | — | |

| Royalty revenue | — | | | 151 | | | 92 | | | 168 | |

| Total revenue | 4,315 | | | 151 | | | 4,407 | | | 168 | |

| | | | | | | |

| Operating expenses: | | | | | | | |

| Research and development | 1,865 | | | 8,838 | | | 7,878 | | | 14,890 | |

| General and administrative | 3,908 | | | 2,891 | | | 7,394 | | | 5,858 | |

| Total operating expenses | 5,773 | | | 11,729 | | | 15,272 | | | 20,748 | |

| Loss from operations | (1,458) | | | (11,578) | | | (10,865) | | | (20,580) | |

| Other income | 313 | | | 459 | | | 314 | | | 490 | |

| | | | | | | |

| Interest expense | (2) | | | (30) | | | (6) | | | (64) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net loss attributable to common stockholders | $ | (1,147) | | | $ | (11,149) | | | $ | (10,557) | | | $ | (20,154) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net loss per common share attributable to common stockholders, basic and diluted | $ | (0.01) | | | $ | (0.16) | | | $ | (0.09) | | | $ | (0.31) | |

| | | | | | | |

| Weighted-average shares used to compute net loss per common share attributable to common stockholders, basic and diluted | 119,486,317 | | | 68,856,370 | | | 119,432,103 | | | 64,646,565 | |

See accompanying notes to these condensed consolidated financial statements.

BRICKELL BIOTECH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF REDEEMABLE PREFERRED STOCK AND STOCKHOLDERS’ EQUITY

(in thousands, except share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Series A Redeemable

Preferred Stock | | Common Stock | | Additional

Paid-In-Capital | | | | Accumulated

Deficit | | Total

Stockholders’

Equity |

| Shares | | Par Value | | Shares | | Par Value | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Balance, December 31, 2021 | — | | | $ | — | | | 119,377,286 | | | $ | 1,194 | | | $ | 169,080 | | | | | $ | (145,367) | | | $ | 24,907 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Stock-based compensation | — | | — | | | — | | — | | | 551 | | | | | — | | | 551 | |

| | | | | | | | | | | | | | | |

| Net loss | — | | — | | | — | | — | | | — | | | | | (9,410) | | | (9,410) | |

| Balance, March 31, 2022 | — | | — | | | 119,377,286 | | 1,194 | | | 169,631 | | | | | (154,777) | | | 16,048 | |

| Issuance of redeemable preferred stock | 1 | | — | | | — | | — | | | — | | | | | — | | | — | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Common stock issued, net of issuance costs of $46 | — | | — | | | 1,419,970 | | 14 | | | 117 | | | | | — | | | 131 | |

| | | | | | | | | | | | | | | |

| Issuance of common stock for cash under employee stock purchase plan | — | | — | | | 268,905 | | 3 | | | 26 | | | | | — | | | 29 | |

| Stock-based compensation | — | | — | | | — | | — | | | 576 | | | | | — | | | 576 | |

| | | | | | | | | | | | | | | |

| Net loss | — | | — | | | — | | — | | | — | | | | | (1,147) | | | (1,147) | |

| Balance, June 30, 2022 | 1 | | $ | — | | | 121,066,161 | | $ | 1,211 | | | $ | 170,350 | | | | | $ | (155,924) | | | $ | 15,637 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Balance, December 31, 2020 | — | | $ | — | | | 53,551,461 | | $ | 536 | | | $ | 132,492 | | | | | $ | (105,893) | | | $ | 27,135 | |

| | | | | | | | | | | | | | | |

| Issuance of common stock upon exercise of warrants | — | | — | | | 12,444,887 | | 124 | | | 8,845 | | | | | — | | | 8,969 | |

Issuance of common stock, net of issuance costs of $50 | — | | — | | | 1,083,548 | | 11 | | | 1,617 | | | | | — | | | 1,628 | |

| Issuance of common stock upon restricted stock unit settlement, net of shares withheld for taxes | — | | — | | | 96,350 | | 1 | | | (53) | | | | | — | | | (52) | |

| Stock-based compensation | — | | — | | | — | | — | | | 469 | | | | | — | | | 469 | |

| | | | | | | | | | | | | | | |

| Net loss | — | | — | | | — | | — | | | — | | | | | (9,005) | | | (9,005) | |

| Balance, March 31, 2021 | — | | | — | | | 67,176,246 | | 672 | | | 143,370 | | | | | (114,898) | | | 29,144 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Common stock issued, net of issuance costs of $259 | — | | — | | | 4,768,976 | | 47 | | | 3,890 | | | | | — | | | 3,937 | |

| Stock-based compensation | — | | — | | | — | | — | | | 421 | | | | | — | | | 421 | |

| | | | | | | | | | | | | | | |

| Net loss | — | | — | | | — | | — | | | — | | | | | (11,149) | | | (11,149) | |

| Balance, June 30, 2021 | — | | $ | — | | | 71,945,222 | | $ | 719 | | | $ | 147,681 | | | | | $ | (126,047) | | | $ | 22,353 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

See accompanying notes to these condensed consolidated financial statements.

BRICKELL BIOTECH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands)

| | | | | | | | | | | |

| Six Months Ended

June 30, |

| 2022 | | 2021 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net loss | $ | (10,557) | | | $ | (20,154) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Stock-based compensation | 1,127 | | | 890 | |

| Depreciation | 13 | | | 8 | |

| | | |

| Gain on loan extinguishment | — | | | (437) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Changes in operating assets and liabilities: | | | |

| Prepaid expenses and other current assets, including long-term portion of contract asset | (1,240) | | | (1,092) | |

| Accounts payable | (342) | | | 1,932 | |

| Accrued liabilities | (1,510) | | | (1,352) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Net cash used in operating activities | (12,509) | | | (20,205) | |

| | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Capital expenditures | — | | | (36) | |

| | | |

| | | |

| Net cash used in investing activities | — | | | (36) | |

| | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| | | |

| | | |

| Proceeds from the issuance of common stock, net of issuance costs | 131 | | | 5,565 | |

| Payments of taxes related to net share settlement of equity awards | (55) | | | — | |

| Proceeds from the issuance of commons stock under employee stock purchase program | 29 | | | — | |

| Proceeds from the exercise of warrants | — | | | 8,969 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Net cash provided by financing activities | 105 | | | 14,534 | |

| | | |

| NET DECREASE IN CASH AND CASH EQUIVALENTS | (12,404) | | | (5,707) | |

| CASH AND CASH EQUIVALENTS—BEGINNING | 26,884 | | | 30,115 | |

| CASH AND CASH EQUIVALENTS—ENDING | $ | 14,480 | | | $ | 24,408 | |

| | | |

| | | |

| | | |

| Supplemental Disclosure of Non-Cash Investing and Financing Activities: | | | |

| Forgiveness of Paycheck Protection Program loan | $ | — | | | $ | 437 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

See accompanying notes to these condensed consolidated financial statements.

BRICKELL BIOTECH, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

NOTE 1. ORGANIZATION AND NATURE OF OPERATIONS

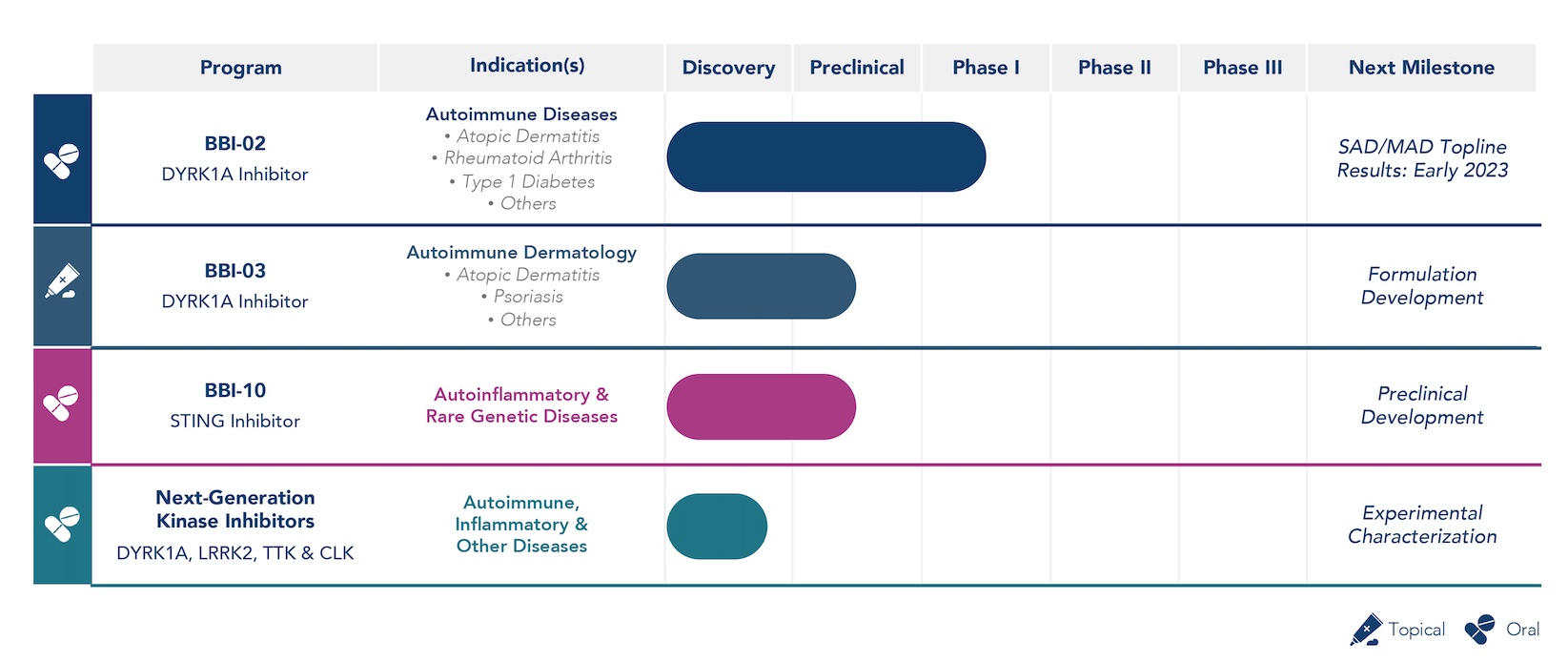

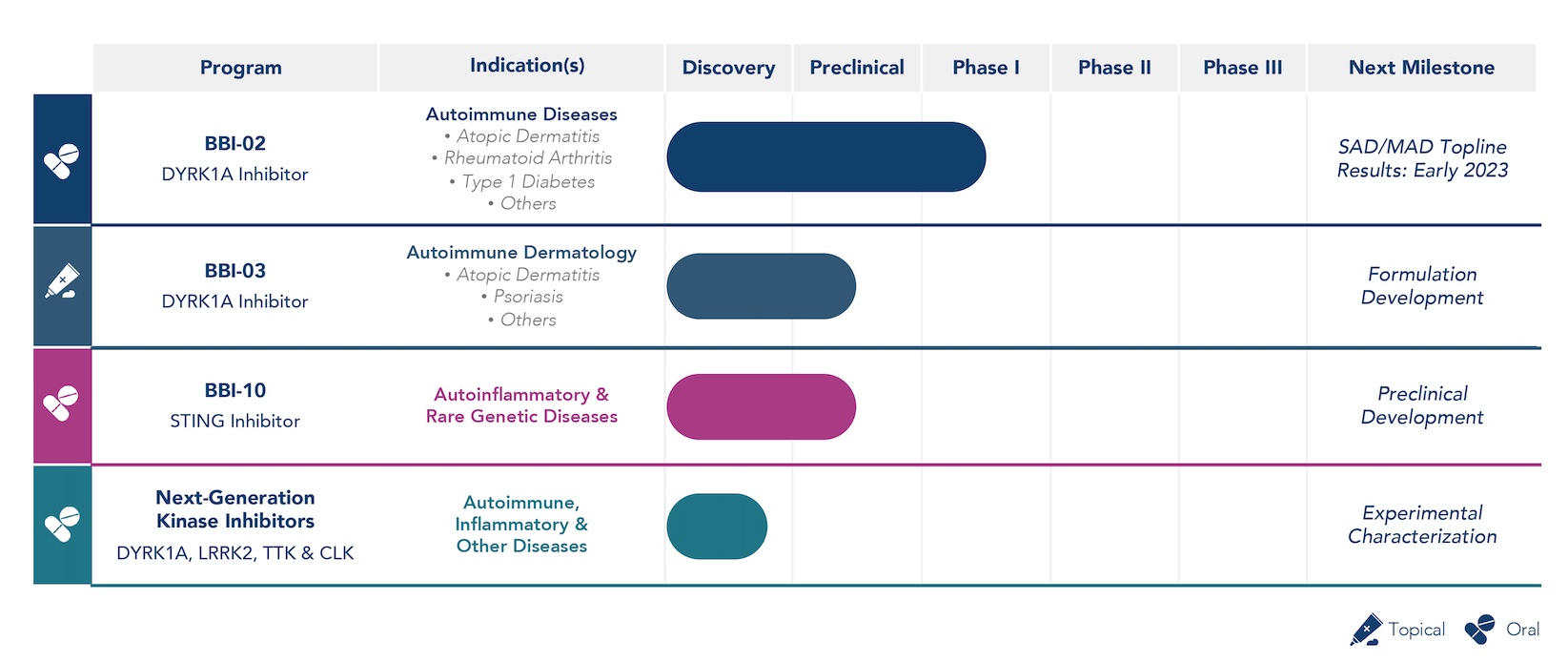

Brickell Biotech, Inc. (the “Company” or “Brickell”) is a clinical-stage pharmaceutical company striving to transform patient lives by developing innovative and differentiated prescription therapeutics for the treatment of autoimmune, inflammatory, and other debilitating diseases. Brickell’s pipeline consists of several development-stage candidates and a cutting-edge platform with broad potential in autoimmune and inflammatory disorders. This includes: BBI-02, a novel, clinical-stage, potential first-in-class, oral DYRK1A inhibitor with strong preclinical validation for treatment of autoimmune and inflammatory diseases, such as atopic dermatitis, rheumatoid arthritis, and type 1 diabetes; BBI-10, a novel, preclinical-stage oral Stimulator of Interferon Genes (STING) inhibitor that has demonstrated dose-dependent cytokine reduction in nonclinical studies providing proof of mechanism for the potential treatment of autoinflammatory and rare genetic diseases; and a platform of next-generation DYRK, CDC2-like kinase (CLK), Leucine-Rich Repeat Kinase 2 (LRRK2), and TTK protein kinase (TTK), also known as Monopolar spindle 1 (Mps1) kinase, inhibitors with the potential to produce treatments for autoimmune, inflammatory, and other debilitating conditions. Brickell’s executive management team and board of directors bring extensive experience in product development and global commercialization, having served in senior leadership roles at large global pharmaceutical companies and biotechs that have developed and/or launched successful products, including several that were first-in-class and/or achieved iconic status, such as Cialis®, Taltz®, Gemzar®, Prozac®, Cymbalta®, Juvederm®, Pluvicto®, and Sofpironium Bromide. Brickell’s strategy is to leverage this experience to in-license, acquire, develop, and commercialize innovative pharmaceutical products that Brickell believes can meaningfully benefit patients who are suffering from chronic, debilitating diseases that are underserved by available therapies.

Reverse Stock Split

Effective July 5, 2022, the Company effected a 1-for-45 reverse stock split of outstanding shares of its common stock. Share and per share amounts reported as of and prior to June 30, 2022 in the condensed consolidated financial statements and notes do not reflect the adjusted share and per share amounts that were effective on and after July 5, 2022, unless otherwise noted. Additional details of the reverse stock split are reported in Note 7. “Capital Stock.”

Liquidity and Capital Resources

The Company has incurred significant operating losses and has an accumulated deficit as a result of ongoing efforts to in-license and develop product candidates, including conducting preclinical and clinical trials and providing general and administrative support for these operations. For the six months ended June 30, 2022, the Company had a net loss of $10.6 million and net cash used in operating activities of $12.5 million. As of June 30, 2022, the Company had cash and cash equivalents of $14.5 million and an accumulated deficit of $155.9 million.

The Company believes that its cash and cash equivalents as of June 30, 2022, combined with $2.0 million from expected near-term payments from Botanix SB Inc. (“Botanix”) under the Asset Purchase Agreement (as defined in Note 3. “Strategic Agreements”), will be sufficient to fund its operations for at least the next 12 months. The Company expects to continue to incur additional substantial losses in the foreseeable future as a result of the Company’s research and development activities. Additional funding will be required in the future to continue with the Company’s planned development and other activities. However, the Company may be unable to raise additional funds, which would have a negative impact on the Company’s business, financial condition, and the Company’s ability to develop its pipeline. To the extent that additional funds are raised through the sale of equity, the issuance of securities will result in dilution to the Company’s stockholders.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiary, Brickell Subsidiary, Inc. (“Brickell Subsidiary”), and are presented in United States (“U.S.”) dollars and have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and applicable rules and regulations of the SEC for interim reporting. As permitted under those rules and regulations, certain footnotes or other financial information normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted. These condensed consolidated financial statements have been prepared on the same basis as the annual financial statements and, in the opinion of management, reflect all adjustments, consisting only of normal recurring adjustments, which are necessary for a fair presentation of the Company’s financial information. The results of operations for the three and six months ended June 30, 2022 are not necessarily indicative of the results to be expected for the full year ending December 31, 2022, for any other interim period, or for any other future period. The condensed consolidated balance sheet as of December 31, 2021 has been derived from audited financial statements at that date but does not include all of the information required by U.S. GAAP for complete financial statements. All intercompany balances and transactions have been eliminated in consolidation. The Company operates in one operating segment and, accordingly, no segment disclosures have been presented herein.

Use of Estimates

The Company’s condensed consolidated financial statements are prepared in accordance with U.S. GAAP, which requires it to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Although these estimates are based on the Company’s knowledge of current events and actions it may take in the future, actual results may ultimately differ from these estimates and assumptions.

Risks and Uncertainties

The Company’s business is subject to significant risks common to early-stage companies in the pharmaceutical industry including, but not limited to, the ability to develop appropriate formulations, scale up and produce the compounds; dependence on collaborative parties; uncertainties associated with obtaining and enforcing patents and other intellectual property rights; clinical implementation and success; the lengthy and expensive regulatory approval process; compliance with regulatory and other legal requirements; competition from other products; uncertainty of broad adoption of its approved products, if any, by physicians and patients; significant competition; ability to manage third-party manufacturers, suppliers, contract research organizations, business partners and other alliances; and obtaining additional financing to fund the Company’s efforts.

The Company expects to incur substantial operating losses for the next several years and will need to obtain additional financing in order to develop its product candidates. There can be no assurance that such financing will be available or will be at terms acceptable to the Company.

Fair Value Measurements

Fair value is the price that the Company would receive to sell an asset or pay to transfer a liability in a timely transaction with an independent counterparty in the principal market, or in the absence of a principal market, the most advantageous market for the asset or liability. A three-tier hierarchy distinguishes between (1) inputs that reflect the assumptions market participants would use in pricing an asset or liability developed based on market

data obtained from sources independent of the reporting entity (observable inputs) and (2) inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing an asset or liability developed based on the best information available in the circumstances (unobservable inputs). The hierarchy is summarized in the three broad levels listed below:

Level 1—quoted prices in active markets for identical assets and liabilities

Level 2—other significant observable inputs (including quoted prices for similar assets and liabilities, interest rates, credit risk, etc.)

Level 3—significant unobservable inputs (including the Company’s own assumptions in determining the fair value of assets and liabilities)

The following table sets forth the fair value of the Company’s financial assets measured at fair value on a recurring basis based on the three-tier fair value hierarchy (in thousands):

| | | | | | | | | | | | | | | |

| Level 1 | | | | |

| | | | | | | |

| | | | | |

| | | | | | | |

| June 30,

2022 | | December 31,

2021 | |

Assets: | | | | | | | |

| Money market funds | $ | 13,480 | | | $ | 25,875 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Fair Value of Financial Instruments

The following methods and assumptions were used by the Company in estimating the fair values of each class of financial instrument disclosed herein:

Money Market Funds—The carrying amounts reported as cash and cash equivalents in the condensed consolidated balance sheets approximate their fair values due to their short-term nature and/or market rates of interest (Level 1 of the fair value hierarchy).

The carrying values of cash equivalents, other current assets, accounts payable, and accrued liabilities approximate fair value due to the short-term maturity of those items.

Revenue Recognition

The Company has recognized revenue primarily from royalty fees received under the Kaken Agreement and upfront fees, research reimbursements, and sublicense income received under the Asset Purchase Agreement described in Note 3. “Strategic Agreements.” The terms of the agreements may include non-refundable upfront fees, funding of research and development activities, payments based upon achievement of milestones, and various sales-based payments.

The Company recognizes revenue upon the transfer of promised goods or services to customers in an amount that reflects the consideration to which the Company expects to be entitled in exchange for those goods or services. In determining the appropriate amount of revenue to be recognized, the Company performs the following five steps: (i) identify the contract(s) with a customer; (ii) identify the performance obligations in the contract; (iii) determine the transaction price, including the constraint on variable consideration; (iv) allocate the transaction price to the performance obligations in the contract; and (v) recognize revenue when (or as) the Company satisfies the performance obligations. At contract inception, the Company assesses the goods or services promised within each contract and assesses whether each promised good or service is distinct and determines those that are performance obligations. The Company then recognizes as revenue the amount of the

transaction price that is allocated to the respective performance obligation when (or as) the performance obligation is satisfied.

The Company utilizes judgment to assess the nature of the performance obligation to determine whether the performance obligation is satisfied over time or at a point in time and, if over time, the appropriate method of measuring progress. The Company evaluates the measure of progress each reporting period and, if necessary, adjusts the measure of performance and related revenue recognition.

Contract Revenue

The Company evaluates its contracts, including asset sale arrangements that involve the Company’s rights to intellectual property, to determine whether they are outputs of the Company’s ordinary activities and whether the counterparty meets the definition of a customer. If the arrangement is determined to be a contract with a customer and the goods or services sold are determined to be distinct from other performance obligations identified in the arrangement, the Company recognizes revenue primarily from non-refundable upfront fees, milestone payments, and sales-based payments allocated to the goods or services when (or as) control is transferred to the customer, and the customer can use and benefit from the goods or services.

Licenses of Intellectual Property

If a license for the Company’s intellectual property is determined to be distinct from the other performance obligations identified in the arrangement, the Company recognizes revenue when the license is transferred to the customer, and the customer can use and benefit from the license.

Milestones

At the inception of each arrangement that includes milestone payments (variable consideration), excluding sales-based milestone payments discussed below, the Company evaluates whether the milestones are considered probable of being reached and estimates the amount to be included in the transaction price using the most likely amount method. The most likely amount method is generally utilized when there are only two possible outcomes and represents the Company’s best estimate of the single most likely outcome to be achieved. If it is probable that a significant revenue reversal would not occur, the variable consideration for the associated milestone is included in the transaction price. Milestone payments contingent on regulatory approvals that are not within the Company and the Company’s collaboration partner’s control, as applicable, are generally not considered probable of being achieved until those approvals are received. At the end of each subsequent reporting period, the Company re-evaluates the probability of achievement of milestones and any related constraint, and if necessary, adjusts the Company’s estimate of the variable consideration. Any such adjustments are recorded on a cumulative catch-up basis, which would affect revenue in the period of adjustment.

Sales-Based Payments

For license arrangements that include sales-based payments such as royalties or milestone payments based on the level of sales, and for which the license is deemed to be the predominant item to which the sales-based payments relate, the Company recognizes revenue at the later of (i) when the related sales occur or (ii) when the performance obligation to which some or all of the sales-based payment has been allocated has been satisfied (or partially satisfied). Sales-based payments received under license arrangements are recorded as royalty revenue in the Company’s condensed consolidated statements of operations.

For non-license arrangements that include sales-based payments, including earnout payments and milestone payments based on the level of sales, the Company estimates the sales-based payments (variable consideration) to be achieved and recognizes revenue to the extent it is probable that a significant reversal in the amount of

cumulative revenue recognized will not occur. The Company may use either the most likely amount, as described above, or the expected value method, in making such estimates based on the nature of the payment to be received and whether there is a wide range of outcomes or only two possible outcomes. The expected value method represents the sum of probability-weighted amounts in a range of possible consideration amounts. The Company bases its estimates using the applicable method described above on factors such as, but not limited to, required regulatory approvals, historical sales levels, market events and projections, and other factors as appropriate. The Company updates its estimates at each reporting period based on actual results and future expectations as necessary.

Contract Asset

For non-license arrangements involving the upfront sale and transfer of the Company’s intellectual property rights, the Company recognizes estimated variable consideration as revenue as discussed above before the customer pays consideration or before payment is due. The excess revenue recognized is presented as a contract asset on the Company’s condensed consolidated balance sheets. Actual amounts paid or due by the customer are recorded as a reduction to the contract asset. Any revisions to the Company’s estimated revenue based on actual results and future expectations are recognized as an adjustment to the contract asset.

Research and Development

Research and development costs are charged to expense when incurred and consist of costs incurred for independent and collaboration research and development activities. The major components of research and development costs include formulation development, nonclinical studies, clinical studies, clinical manufacturing costs, in-licensing fees for development-stage assets, salaries and employee benefits, and allocations of various overhead and occupancy costs. Research costs typically consist of applied research, preclinical, and toxicology work. Pharmaceutical manufacturing development costs consist of product formulation, chemical analysis, and the transfer and scale-up of manufacturing at contract manufacturers. Assets acquired (or in-licensed) that are utilized in research and development that have no alternative future use are expensed as incurred. Milestone payments related to the Company’s acquired (or in-licensed) assets are recorded as research and development expenses when probable and reasonably estimable.

The Company has entered into and may continue to enter into licensing or subscription arrangements to access and utilize certain technology. In each case, the Company evaluates if the license agreement results in the acquisition of an asset or a business. To date, none of the Company’s license agreements have been considered an acquisition of a business. For asset acquisitions, the upfront payments to acquire such licenses, as well as any future milestone payments made before product approval that do not meet the definition of a derivative, are immediately recognized as research and development expenses when they are paid or become payable, provided there is no alternative future use of the rights in other research and development projects.

Clinical Trial Accruals

Expense accruals related to clinical trials are based on the Company’s estimates of services received and efforts expended pursuant to contracts with multiple research institutions and third-party clinical research organizations that conduct and manage clinical trials on the Company’s behalf. The financial terms of these agreements vary from contract to contract and may result in uneven payment flows. Payments under some of these contracts depend on factors such as the successful enrollment of patients and the completion of clinical trial milestones. In accruing costs, the Company estimates the period over which services will be performed and the level of effort to be expended in each period based upon patient enrollment, clinical site activations, or information provided to the Company by its vendors on their actual costs incurred. Any estimates of the level of services performed or the costs of these services could differ from actual results.

Net Loss per Share

Basic and diluted net loss per share is computed by dividing net loss by the weighted-average number of common shares outstanding. When the effects are not anti-dilutive, diluted earnings per share is computed by dividing the Company’s net income by the weighted-average number of common shares outstanding and the impact of all potentially dilutive common shares. Diluted net loss per share is the same as basic net loss per share, as the effects of potentially dilutive securities are anti-dilutive for all periods presented.

The following table sets forth the potential common shares excluded from the calculation of diluted net loss per share because their inclusion would be anti-dilutive:

| | | | | | | | | | | | | | | |

| | | Three and Six Months Ended

June 30, |

| | | | | 2022 | | 2021 |

| Outstanding warrants | | | | | 27,944,544 | | | 27,944,544 | |

| Outstanding options | | | | | 10,449,516 | | | 6,716,167 | |

| Unvested restricted stock units | | | | | — | | | 47,435 | |

| | | | | | | |

| | | | | | | |

| Total | | | | | 38,394,060 | | | 34,708,146 | |

Leases

The Company determines if an arrangement is a lease at inception. Operating leases with a term greater than one year are recognized on the balance sheet as right-of-use assets, lease liabilities and, if applicable, long-term lease liabilities. The Company does not currently hold any financing leases. The Company has elected the practical expedient not to recognize on the balance sheet leases with terms of one year or less and not to separate lease components and non-lease components for long-term real estate leases. Lease liabilities and their corresponding right-of-use assets are recorded based on the present value of lease payments over the expected lease term. The interest rate implicit in lease contracts is typically not readily determinable. As such, the Company estimates the incremental borrowing rate in determining the present value of lease payments. The Company’s headquarters operating lease has one single component. The lease component results in a right-of-use asset being recorded on the balance sheet, which is amortized as lease expense on a straight-line basis in the Company’s condensed consolidated statements of operations.

Redeemable Preferred Stock

The Company issued one share of redeemable preferred stock in May 2022. The redeemable preferred stock contained provisions that required redemption under circumstances that were outside of the Company’s control and was classified as a mezzanine instrument outside of the Company’s capital accounts. The share of redeemable preferred stock was sold to one investor for $10 and was subsequently redeemed in July 2022, as described further in Note 7. “Capital Stock.”

New Accounting Pronouncements

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board or other standard setting bodies that the Company adopts as of the specified effective date. The Company does not believe that the adoption of recently issued standards has had or will have a material impact on the Company's condensed consolidated financial statements or disclosures.

NOTE 3. STRATEGIC AGREEMENTS

Exclusive License and Development Agreement with Carna

On February 2, 2022, the Company entered into an Exclusive License Agreement (the “Carna License Agreement”) with Carna Biosciences, Inc. (“Carna”), pursuant to which the Company acquired exclusive, worldwide rights to research, develop, and commercialize Carna’s portfolio of novel STING inhibitors. In accordance with the terms of the Carna License Agreement, in exchange for the licensed rights, the Company made a one-time cash payment of $2.0 million, which was recorded as research and development expenses in the condensed consolidated statements of operations during the six months ended June 30, 2022.

The Carna License Agreement provides that the Company will make success-based payments to Carna of up to $258.0 million in the aggregate contingent upon achievement of specified development, regulatory, and commercial milestones. Further, the Carna License Agreement provides that the Company will pay Carna tiered royalty payments ranging from mid-single digits up to 10% of net sales. All of the contingent payments and royalties are payable in cash in U.S. Dollars. Under the terms of the Carna License Agreement, the Company is responsible for, and bears the future costs of, all development and commercialization activities, including patenting, related to all the licensed compounds. As of June 30, 2022 and through the date of this Quarterly Report, the Company has not yet made any payments or recorded any liabilities related to the specified development, regulatory, and commercial milestones or royalties on net sales pursuant to the Carna License Agreement.

License and Development Agreement with Voronoi

On August 27, 2021, the Company entered into a License and Development Agreement (the “Voronoi License Agreement”) with Voronoi Inc. (“Voronoi”), pursuant to which the Company acquired exclusive, worldwide rights to research, develop, and commercialize BBI-02, a novel, clinical-stage, potential first-in-class, oral DYRK1A inhibitor, and other next-generation kinase inhibitors. In accordance with the terms of the Voronoi License Agreement, in exchange for the licensed rights, the Company made a one-time payment of $2.5 million in cash and issued $2.0 million, or 2,816,901 shares, of its common stock to Voronoi.

With respect to BBI-02, the Voronoi License Agreement provides that the Company will make payments to Voronoi of up to $211.0 million in the aggregate contingent upon achievement of specified development, regulatory, and commercial milestones. With respect to the next-generation compounds arising from the novel kinase inhibitor platform, the Company will make payments to Voronoi of up to $107.5 million in the aggregate contingent upon achievement of specified development, regulatory, and commercial milestones. Further, the Voronoi License Agreement provides that the Company will pay Voronoi tiered royalty payments ranging from low-single digits up to 10% of net sales of products arising from the DYRK1A inhibitor programs and next-generation kinase inhibitor platform. All of the contingent payments and royalties are payable in cash in U.S. Dollars, except for $1.0 million of the development and regulatory milestone payments, which amount is payable in equivalent shares of the Company’s common stock. Under the terms of the Voronoi License Agreement, the Company is responsible for, and bears the future costs of, all development and commercialization activities, including patenting, related to all the licensed compounds. As of June 30, 2022 and through the date of this Quarterly Report, the Company has not yet made any payments or recorded any liabilities related to the specified development, regulatory, and commercial milestones or royalties on net sales pursuant to the Voronoi License Agreement.

Asset Purchase Agreement with Botanix

On May 3, 2022 (the “Effective Date”), the Company and Brickell Subsidiary entered into an asset purchase agreement with Botanix and Botanix Pharmaceuticals Limited (the “Asset Purchase Agreement”), pursuant to which Botanix acquired and assumed control of all rights, title, and interests to assets primarily related to the

proprietary compound sofpironium bromide that were owned and/or licensed by the Company or Brickell Subsidiary (the “Assets”). The Company had previously entered into a License Agreement with Bodor Laboratories, Inc. (“Bodor”), dated December 15, 2012 (last amended in February 2020) that provided the Company with a worldwide exclusive license to develop, manufacture, market, sell, and sublicense products containing sofpironium bromide through which the Assets were developed (the “Amended and Restated License Agreement”). As a result of the Asset Purchase Agreement, Botanix is now responsible for all further research, development, and commercialization of sofpironium bromide globally and replaced the Company as the exclusive licensee under the Amended and Restated License Agreement.

In accordance with the sublicense rights provided to the Company under the Amended and Restated License Agreement, the Company also previously entered into a License, Development, and Commercialization Agreement with Kaken Pharmaceutical Co., Ltd. (“Kaken”), dated as of March 31, 2015 (as amended in May 2018, the “Kaken Agreement”), under which the Company granted to Kaken an exclusive right to develop, manufacture, and commercialize the sofpironium bromide compound in Japan and certain other Asian countries (the “Territory”). In exchange for the sublicense, the Company was entitled to receive aggregate payments of up to $10.0 million upon the achievement of specified development milestones, which was earned and received in 2017 and 2018, and up to $19.0 million upon the achievement of sales-based milestones, as well as tiered royalties based on a percentage of net sales of licensed products in the Territory. In September 2020, Kaken received regulatory approval in Japan to manufacture and market sofpironium bromide gel, 5% (ECCLOCK®) for the treatment of primary axillary hyperhidrosis, and as a result, the Company began recognizing royalty revenue earned on a percentage of net sales of ECCLOCK in Japan. Pursuant to the Asset Purchase Agreement, the Kaken Agreement was also assigned to Botanix, which replaced the Company as the exclusive sub-licensor to Kaken. During the three and six months ended June 30, 2022, prior to entering into the Asset Purchase Agreement, the Company recognized royalty revenue of $0 and $0.2 million, respectively, under the Kaken Agreement. During the three and six months ended June 30, 2021, the Company recognized royalty revenue of $0.1 million and $0.2 million, respectively.

The Company determined that the development of and ultimate sale and assignment of rights to the Assets is an output of the Company’s ordinary activities and Botanix is a customer as it relates to the sale of the Assets and related activities.

In accordance with the terms of the Asset Purchase Agreement, in exchange for the Assets, the Company (i) received an upfront payment at closing in the amount of $3.0 million, (ii) is to be reimbursed for certain recent development expenditures in advancement of the Assets, and (iii) will receive from Botanix contingent near-term milestone payments of (a) $2.0 million upon the acceptance by the U.S. Food and Drug Administration (“FDA”) of the filing of a new drug application (“NDA”) for sofpironium bromide gel, 15%, and (b) $4.0 million if marketing approval in the U.S. for sofpironium bromide gel, 15%, is received on or before September 30, 2023, or $2.5 million if such marketing approval is received after September 30, 2023 but on or before February 17, 2024. The Company also is eligible to receive additional success-based regulatory and sales milestone payments of up to $168 million. Further, the Company will receive tiered earnout payments ranging from high-single digits to mid-teen digits on net sales of sofpironium bromide gel (the “Earnout Payments”).

The Asset Purchase Agreement also provides that Botanix will pay to the Company a portion of the sales-based milestone payments and royalties that Botanix receives from Kaken under the Kaken Agreement (together, the “Sublicense Income”). During the three and six months ended June 30, 2022, the Company recorded contract revenue for the upfront payment received by the Company from Botanix of $3.0 million, reimbursed development expenditures from Botanix under the Asset Purchase Agreement of $0.6 million, and fees for consulting services the Company provided under the TSA (as defined below) of $0.4 million. Additionally, during the three and six months ended June 30, 2022, the Company recognized contract revenue of $0.3 million related to the Sublicense Income, which represents the Company’s estimate of payments that will be earned by the Company in the applicable period from royalties Botanix will receive from Kaken to the extent it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur. Such payments vary

based on net sales that are impacted by a wide variety of market and other factors and, as such, the Company utilized the expected value approach, which the Company believes will best predict the amount of consideration to which it will be entitled. In relation to the sales-based milestone payments that Botanix may receive from Kaken in the future, the Company utilized the most likely amount method and determined it is not yet probable that the Company will receive any payments from Botanix in relation to such milestone payments. Therefore, the Company determined that such milestone payments are fully constrained as of June 30, 2022, and, as such, have not yet been recognized as contract revenue.

All other consideration due under the Asset Purchase Agreement is contingent upon certain regulatory approvals and future sales subsequent to such regulatory approvals or is based upon future sales that the Company determined are not yet probable due to such revenues being highly susceptible to factors outside of the Company’s influence and uncertainty about the amount of such consideration that will not be resolved for an extended period of time. Therefore, the Company determined that such variable consideration amounts are fully constrained as of June 30, 2022, and as such, did not recognize such amounts as contract revenue.

With respect to the recognition of contract revenue for the Sublicense Income based on future royalties that will be due to Botanix from Kaken, certain amounts are not yet due from Botanix. Therefore, the Company has recorded a contract asset equal to the amount of revenue recognized to date related to the Sublicense Income, less the amount of payments received from or due by Botanix in relation to the Sublicense Income to date. As of June 30, 2022, the contract asset related to the Sublicense Income is $0.3 million, of which $0.2 million is included within prepaid expenses and other current assets in the condensed consolidated balance sheet.

Transition Services Agreement with Botanix

In connection with the sale of the Assets, on the Effective Date, the Company and Botanix entered into a transition services agreement (the “TSA”) whereby the Company is providing consulting services as an independent contractor to Botanix in support of and through filing and potential approval of the U.S. NDA for sofpironium bromide gel, 15%. In accordance with the terms of the TSA, in exchange for providing these services, the Company will receive from Botanix, (i) prior to the acceptance of the filing by the FDA of such NDA, a fixed monthly amount of $71 thousand, and (ii) after the acceptance of the filing by the FDA of such NDA, a variable amount based upon actual hours worked, in each case plus related fees and expenses of the Company’s advisors (plus a 5% administrative fee) and the Company’s out-of-pocket expenses. During the three and six months ended June 30, 2022, the Company recognized contract revenue of $0.4 million related to these services.

Agreements with Bodor

In connection with the sale of the Assets, on the Effective Date, the Company, Brickell Subsidiary, and Bodor entered into an agreement (the “Rights Agreement”) to clarify that the Company and Brickell Subsidiary have the power and authority under the Amended and Restated License Agreement to enter into the Asset Purchase Agreement and the TSA, and that Botanix would assume the Amended and Restated License Agreement pursuant to the Asset Purchase Agreement. The Rights Agreement includes a general release of claims and no admission of liability between the parties. Pursuant to such Rights Agreement, the Company has agreed to pay Bodor (i) 18% of the amount of each payment actually received by the Company from Botanix for upfront and milestone payments under the Asset Purchase Agreement, as well as (ii) certain tiered payments, set as a percentage ranging from mid-single digits to low-teen digits, of the actual amount of each of the applicable Earnout Payments received by the Company from Botanix. During the three and six months ended June 30, 2022, the Company incurred $0.5 million of general and administrative expenses for payments due to Bodor.

Pursuant to the terms of the Asset Purchase Agreement, the Company retained its obligation under the Amended and Restated License Agreement to issue $1.0 million in shares of its common stock to Bodor upon the FDA’s acceptance of an NDA filing for sofpironium bromide gel, 15%. As such regulatory milestone event has not yet

been achieved, no research and development expenses associated with milestones were incurred during the three or six months ended June 30, 2022 and 2021. Prior to the execution of the Rights Agreement, the Company paid Bodor immaterial amounts with respect to the royalties the Company received from Kaken for sales of sofpironium bromide gel, 5% (ECCLOCK) in Japan during those periods.

NOTE 4. DETAILED ACCOUNT BALANCES

Prepaid expenses and other current assets consisted of the following (in thousands):

| | | | | | | | | | | |

| June 30,

2022 | | December 31,

2021 |

| Prepaid clinical trial costs | $ | 2,390 | | | $ | 1,443 | |

| Prepaid insurance | 694 | | | 921 | |

| Accounts receivable | 358 | | | 125 | |

| Other prepaid expenses | 170 | | | 168 | |

| Contract asset | 152 | | | — | |

| Other short-term assets | 7 | | | 59 | |

| Total | $ | 3,771 | | | $ | 2,716 | |

Accrued liabilities consisted of the following (in thousands):

| | | | | | | | | | | |

| |

| | | |

| June 30,

2022 | | December 31,

2021 |

| Accrued compensation | $ | 1,016 | | | $ | 1,861 | |

| Accrued professional fees | 382 | | | 452 | |

| Accrued contracted research and development services | 173 | | | 823 | |

| | | |

| | | |

| | | |

| | | |

| Total | $ | 1,571 | | | $ | 3,136 | |

NOTE 5. NOTE PAYABLE

On April 15, 2020, the Company executed an unsecured promissory note to IberiaBank (the “PPP Loan”) pursuant to the U.S. Small Business Administration’s Paycheck Protection Program (the “PPP”) under Division A, Title I of the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”). The Company used the PPP Loan proceeds in the principal amount of $0.4 million and bearing interest at a fixed rate of 1.00% per annum to cover payroll costs and certain other permitted costs in accordance with the relevant terms and conditions of the CARES Act. In January 2021, the Company applied for forgiveness of the full amount of the PPP Loan, which was forgiven in full in June 2021. As a result, during the six months ended June 30, 2021, the Company recognized a gain on extinguishment of debt of approximately $0.4 million in the condensed consolidated statements of operations within the line “Other income.”

NOTE 6. COMMITMENTS AND CONTINGENCIES

Operating Lease

In August 2016, the Company entered into a multi-year, noncancelable lease for its Colorado-based office space, which was amended in June 2021 to, among other things, extend the lease term to December 31, 2022 (as amended, the “Boulder Lease”). Under the terms of the Boulder Lease, the Company may, at its option, renew the Boulder Lease for two additional terms of three years each, with monthly rent payments determined at the time of renewal at the lower of $6,076 per month or current market rental rates. The Company recognized a right-of-use asset and corresponding lease liability. Minimum base lease payments under the Boulder Lease are

recognized on a straight-line basis over the full term of the lease. In addition to base rental payments included in the contractual obligations table below, the Company is responsible for its pro rata share of the operating expenses for the building, which includes common area maintenance, utilities, property taxes, and insurance.

Upon modification of the Boulder Lease, the Company reassessed classification of the lease and determined that the lease still met the criteria to be classified as an operating lease. Furthermore, the Company remeasured the lease liability as of the effective date by calculating the present value of the new lease payments, discounted at the Company’s updated incremental borrowing rate of 11.0%, over the extended term of 18 months. The operating expenses are variable and are not included in the present value determination of the lease liability. Because the Company was not reasonably certain to exercise the renewal option, the option was not considered in determining the lease term, and associated potential additional payments were excluded from lease payments.

The following is a summary of the contractual obligations related to operating lease commitments as of June 30, 2022 (in thousands):

| | | | | | | | |

| | |

| | |

| | |

| Total maturities, through December 31, 2022 | | $ | 37 | |

| Less imputed interest | | (1) | |

| Present value of lease liability | | $ | 36 | |

Licensing and Other Agreements

Refer to Note 3. “Strategic Agreements” for more information about the Company’s obligations under its licensing and other agreements.

NOTE 7. CAPITAL STOCK

Common Stock

Under the Company’s amended and restated certificate of incorporation, the Company’s board of directors has the authority to issue up to 300,000,000 shares of common stock with a par value of $0.01 per share. Each share of the Company’s common stock is entitled to one vote, and the holders of the Company’s common stock are entitled to receive dividends when and as declared or paid by its board of directors. The Company had reserved authorized shares of common stock for future issuance as of June 30, 2022 as follows:

| | | | | |

| June 30,

2022 |

| Common stock warrants | 27,944,544 | |

| Common stock options outstanding | 10,449,516 | |

| Shares available for grant under the Omnibus Plan | 5,627,209 | |

| Shares available for grant under the Employee Stock Purchase Plan | 2,181,810 | |

| |

| |

| |

| Total | 46,203,079 | |

Public Offerings of Common Stock and Warrants

In October 2021, the Company completed a sale of 30,263,400 shares of its common stock at a public offering price of $0.38 per share in an underwritten public offering (the “October 2021 Offering”). The October 2021 Offering resulted in net proceeds of approximately $10.3 million, after deducting the underwriting discount and offering expenses payable by the Company.

In July 2021, the Company completed a sale of 12,983,871 shares of its common stock at a public offering price of $0.62 per share in an underwritten public offering (the “July 2021 Offering”). The July 2021 Offering

resulted in net proceeds of approximately $7.3 million, after deducting underwriting discounts and commissions and offering expenses payable by the Company.